Manhattan Life Assurance for Beginners

Table of ContentsThe smart Trick of Plan G Medicare That Nobody is Talking AboutUnknown Facts About Aarp Medicare Supplement Plan FFacts About Medigap Plan G RevealedSome Ideas on Hearing Insurance For Seniors You Should KnowThe Of Medicare Plan G Joke

(by mail), even if they do not additionally obtain Medicaid. The card is the mechanism for wellness care carriers to bill the QMB program for the Medicare deductibles and also co-pays.

Links to their webinars and various other sources goes to this link. Their details includes: September 4, 2009, upgraded 6/20/20 by Valerie Bogart, NYLAG This short article was authored by the Realm Justice Center.

The Facts About Medigap Plan G Revealed

Each state's Medicaid program pays the Medicare cost-sharing for QMB program members. Anyone that gets approved for the QMB program does not have to spend for Medicare cost-sharing and can not be charged by their wellness care suppliers. If an individual is taken into consideration a QMB Plus, they fulfill all requirements for the QMB program yet likewise fulfill all monetary requirements to obtain full Medicaid solutions.

The initial step in registration for the QMB program is to find out if you're eligible. You can ask for Medicaid to supply you with an application form or find a QMB program application from your state online.

There are circumstances in which states may limit the quantity they pay healthcare service providers for Medicare cost-sharing. Also if a state restricts the amount they'll pay a provider, QMB members still do not need to pay Medicare companies for their healthcare expenses and also it's versus the law for a copyright to ask them to pay - medicare plan g.

Generally, there is a costs for the plan, yet the Medicaid program will certainly pay that premium. Several people pick this additional protection because it gives routine oral and vision treatment, and also some come with a gym subscription.

Our Aarp Medicare Supplement Plan F Statements

Enter your zip code to pull strategy alternatives available in your area. Select which Medicare plans you would love to contrast in your area. Contrast prices alongside with strategies & service providers readily available in your location. Jagger Esch is the Medicare specialist for Medicare, frequently asked question and also the owner, head of state, and also chief executive officer of Elite Insurance Policy Allies and also Medicare, FAQ.com.

He is featured in numerous publications along with creates routinely for other expert columns concerning Medicare.

Many states permit this throughout the year, yet others restrict when you can enlist in Component A. Bear in mind, states utilize different rules to count your income and also properties to figure out if you are eligible for an MSP. Instances of revenue consist of wages as well as Social Security benefits you get. Instances of properties consist of examining accounts and also stocks.

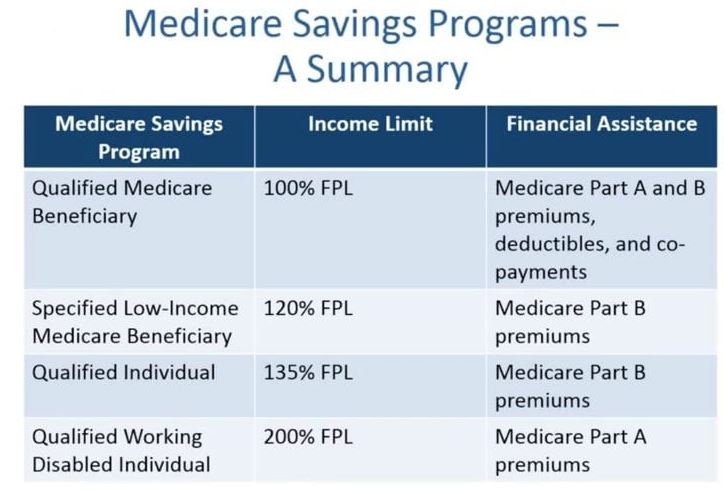

And also some states do not have a property limitation. If your income or properties seem to be over the MSP standards, you ought to still use if you need the help. * Certified Disabled Functioning Individual (QDWI) is the 4th MSP as well as pays for the Medicare Component A premium. To be eligible for QDWI, you have to: Be under age 65 Be working but remain to have a disabling disability Have limited revenue and properties As well as, not currently be eligible for Medicaid.

Excitement About Manhattan Life Assurance

20 for each brand-name medicine that is covered. Bonus Aid just uses to Medicare Component D.

Various states may have various means to calculate your earnings and also sources. Let's take a look at each of the QMB program qualification criteria in more information listed below.

The monthly income limit for the QMB program enhances each year. Resource limitations, In enhancement to a month-to-month income limit, there is also a resource limit read this post here for the QMB program.

The 2-Minute Rule for Aarp Medicare Supplement Plan F

Like earnings limitations, the resource restrictions for the QMB program are various depending on whether you're married. For 2021, the source limitations for the QMB program are: $7,970 $11,960 Source limits also increase yearly. Similar to income limitations, you should still get the QMB program if your resources have actually slightly raised.